Financial modeling software: key features, best tools & benefits

January 9, 2025

- Home

- Industries

- Finance

- Financial modeling software

Senior Quantitative Analyst

Financial modeling software helps companies create accurate financial forecasts, predict their future performance, assess investment opportunities, and model different business scenarios to make informed decisions and maximize profitability.

Itransition assists companies with the implementation of secure and scalable financial modeling solutions that improve financial planning and support strategic decision-making.

Key features of financial modeling software

While software capabilities can vary based on a company’s needs, here are some features essential for an efficient financial modeling process.

Financial model templates

Ready-made templates for common financial models (like a three statement model based on the balance sheet, cash flow statement, and income statement) and a pre-set directory of calculations and assumption types help financial analysts save time on model generation.

_0.png)

Image title: Income statement

Image source: ey.com — The ultimate guide to financial modeling for startups

Custom model creation

The ability to create bespoke financial models based on historical financial data from relevant business systems as well as user-defined parameters and variables allows financial analysts to tailor projections, insights, and recommendations to the company’s business needs.

.png)

Image title: Example of a custom financial model

Image source: quantrix.com

Scenario analysis

The functionality for creating and comparing financial scenarios based on different variables and assumptions enables businesses to assess possible outcomes and risks of each scenario and choose the best financial strategy.

.png)

Image title: Example of M&A scenario analysis

Financial forecasting

Features that enable financial analysts to accurately project cash flows, expenses, and income for monthly, quarterly, or annual periods and create realistic rolling forecasts allow companies to make more informed strategic and day-to-day financial business decisions.

.png)

Image title: Liabilities forecast

Image source: educba.com — What is Discounted Cash Flow

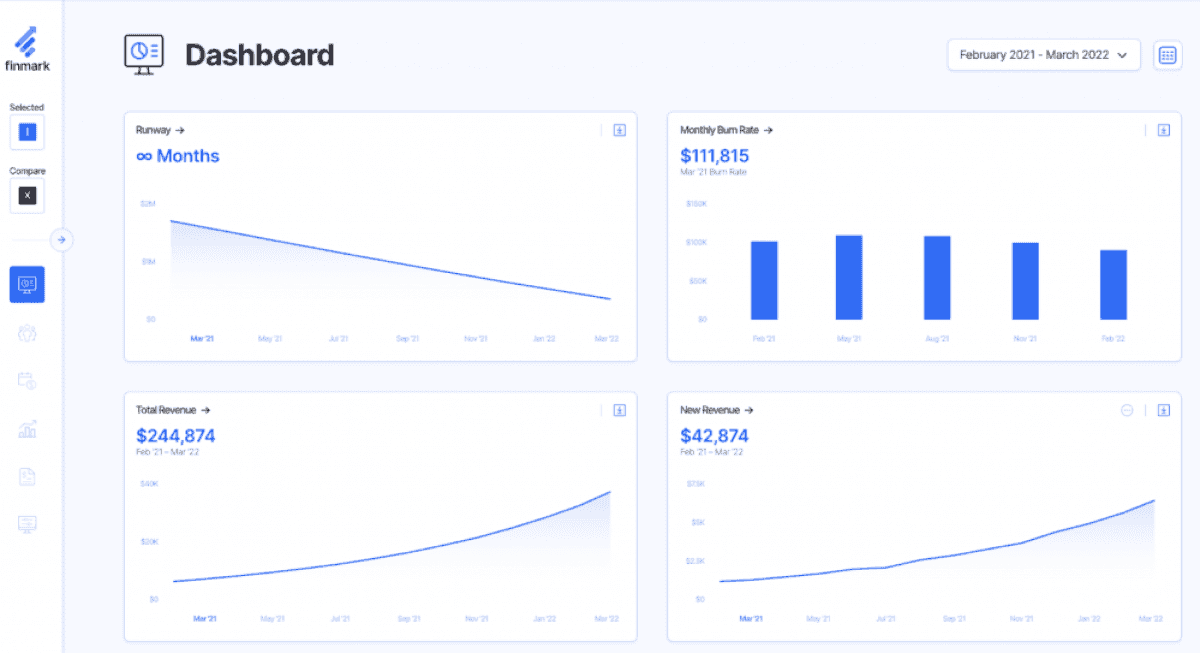

Data visualization & reporting

The ability to present complex financial information via charts and graphs arranged in intuitive dashboards helps users to easily detect trends, compare scenarios, and communicate insights to stakeholders for faster and more effective business decisions.

Image title: Financial model dashboard

Image source: finmark.com — What is Financial Modeling?

Collaboration features

With capabilities like commenting, tagging, model sharing, and version control, finance teams can effectively collaborate on data analysis, speeding up the financial planning process while keeping a clear record of all changes made to models.

Security mechanisms

Сomprehensive security features, including role-based access control, tiered user permissions, data encryption, and audit trails, help prevent unauthorized access to financial data and ensure its integrity and safety.

Need a robust financial modeling solution?

Top platforms with financial modeling capabilities

Microsoft Dynamics 365 Finance

Microsoft Dynamics 365 Finance is a financial management suite designed to help companies maximize their financial visibility and profitability.

Key features

- Consolidation of cross-departmental data

- Scenario planning

- Customer payment predictions

- Cash flow projections

- Budget proposals

- Collaboration features

- Seamless integration with other Microsoft products, including Excel and Power BI

Advantages

- Comprehensive finance management capabilities

- AI-capabilities for intelligent forecasting and automation

- 30-day free trial

Limitations

Potential customization requires developers’ help

Best for

Midsize businesses to large enterprises

Pricing

- Finance

$210 user/month

- Finance Premium

$300 user/month

Oracle Cloud EPM

Oracle Cloud Enterprise Performance Management (EPM) is a suite of applications that provide financial modeling and planning functionality for finance and operational analysts.

Key features

- Financial statement analysis

- Large-scale, freeform ad-hoc modeling

- Scenario modeling

- Revenue and expenses planning

- Predictive cash planning

- Weekly, monthly, and quarterly rolling forecasting

- Industry-specific configurations

Advantages

- Flexible deployment options, with necessary modules implemented independently from other platform’s components

- Built-in financial intelligence

Limitations

Configuration requires dedicated expertise

Best for

Mid-size companies to large enterprises

Pricing

Upon request

Quantrix

Quantrix is advanced financial modeling software that enables financial teams across industries to intuitively model financial and operational scenarios.

Key features

- Multi-dimensional modeling

- Real-time “what-if” scenario analysis

- Natural language formulas

- Long-term forecasting using time-aware models

- Free-form custom dashboards

- Cloud collaboration

- Robust data source integration capabilities

Advantages

- 30-day free trial

- On-premises and SaaS deployment options

- Complex, multiple-entity hierarchy modeling

Limitations

A steep learning curve

Best for

Enterprise-level companies

Pricing

Upon request

Jirav

Jirav is a comprehensive cloud-based financial modeling, planning, budgeting, and reporting solution.

Key features

- Company-wide data merging, including accounting, workforce, and operational data

- Dynamic driver-based financial modeling

- Annual planning and budgeting, including departmental planning

- Monthly rolling forecasts

- Ad-hoc reporting and real-time dashboards with industry-specific KPIs or custom metrics

- Collaboration features

- Pre-built integrations with Microsoft Excel, Google Sheets, QuickBooks, NetSuite, Salesforce, Tableau, and other services

Advantages

- Pre-built industry-specific templates and solutions

- FP&A expert provided by the vendor to help with the implementation

Limitations

- A steep learning curve

- Limited visualizations

Best for

Accounting and CFO advisory firms, small businesses, and midsize companies

Pricing

- For accounting & CFO firms

from $30/month

- For businesses

from $20,000/team

Cube

Cube is a robust no-code platform that automates financial planning and analysis processes, letting companies keep their established workflows and streamline them to achieve faster strategic decision-making.

Key features

- Automated data consolidation from numerous data sources

- Multi-scenario analysis

- Customizable dashboards

- Audit trails

- Native integrations with Microsoft Excel and Google Sheets

- Multi-currency support

Advantages

- Seamless work as an add-on within companies’ current spreadsheets

- AI capabilities, including anomaly detection for financial data sets and AI Smart Forecasting

- Onboarding support

Limitations

Available only for companies in the US and Canada

Best for

Midsize companies to large enterprises

Pricing

Custom pricing from $2,000/month

Finmark

Finmark is financial planning software designed for startups and small businesses to help them develop growth strategies and speed up fundraising without spreadsheets.

Key features

- Real-time financial analysis

- Multiple scenario analysis

- Budgeting, including budget vs actuals comparison and revenue projections

- Automated hiring planning

- Collaboration features

- Fundraising planning

- Pre-built integrations with popular business tools, like QuickBooks, Xero, and Stripe

Advantages

30-day free trial

Limitations

Integrating the platform with other systems can be challenging

Best for

- Startups

- Small to mid-size businesses

Pricing

Starts at $50/month and increases based on a company’s annual revenue

IBM Cognos Analytics

IBM Cognos Analytics is a comprehensive business intelligence solution that allows a company to get a real-time, accurate, and complete picture of their operations.

Key features

- Advanced customizable reports

- Dynamic dashboards

- AI analytics assistant

- Self-service analytics

- Data exploration and predictive forecasting

Advantages

- 30-day free trial

- On-premises and cloud deployment options

- Both on-premise and cloud data collection

Limitations

Substantial training is required to use the platform effectively

Best for

- Midsize organizations

- Large organizations

Pricing

- Standard plan

starts at $10.60/month/user

- Premium plan

starts at $42.40/month/user

Prophix

Prophix is a cloud-based financial performance platform that streamlines key finance processes and enhances decision-making.

Key features

- Budgeting and planning

- Reporting and analytics

- Forecasting

- AI capabilities, including intelligent automation, smart data visualization, and report insights

- Built-in integration with Microsoft 365 & Power BI

- Collaboration tools

Advantages

- User-friendly design

- Comprehensive customer support

Limitations

Slow assumption processing when building forecasts

Best for

- Small companies

- Mid-sized companies

Pricing

Upon request

Anaplan

Anaplan is a cloud-based planning platform designed to help finance teams and business users connect and optimize key business processes across finance, supply chain, sales, marketing, and human resources.

Key features

- Integration of financial, sales, and operational data for seamless financial forecasting across the enterprise

- Aggressive, conservative, “what-if,” and other scenario modeling

- Flexible driver-based forecasts

- Advanced modeling capabilities for intricate business models

- Real-time model sharing and editing

Advantages

- Automated data validation

- Advanced predictive analytics functionality with explainability and impact scoring

Limitations

- A steep learning curve

- Limited visibility into license and user counts

Best for

Large enterprises

Pricing

Custom pricing in three plans, Basic, Professional, and Enterprise

Benefits of financial modeling software

Accurate financial analysis

With data automatically pulled from relevant corporate systems and quickly processed, companies can correctly evaluate their current and future financial performance, as well as the impact of various business decisions on their bottom lines.

Effective risk mitigation

Using financial modeling tools, companies can simulate true-to-life business conditions to identify potential financial risks and plan appropriate actions to mitigate them.

Better investment strategies

Both businesses and investors can make more informed investment decisions relying on the accurate picture of the company’s financial health and market conditions provided by financial modeling software.

Higher financial team productivity

By automating data entry, calculations, and financial report generation and facilitating collaboration, financial modeling software frees team members from repetitive, time-consuming tasks and enables them to dedicate their time to more strategic and analytical activities.

Real-life example of financial modeling software

Billions

in investments managed

Investment portfolio management ecosystem

We created a web platform that enables investors to track and manage their investment portfolios, equipping the platform with financial modeling capabilities to help analyze stock and market trends for more informed investment decisions.

Common integrations for financial modeling software

Financial modeling tools require syncing with multiple data sources to automate the input of information relevant for the analysis.

Financial modeling software

ERP

CRM

Accounting software

Payroll systems

Treasury management systems

Market data services

AI for financial modeling

Artificial intelligence can be used in financial modeling to enhance traditional financial modeling techniques. AI algorithms can analyze large volumes of structured and unstructured corporate data and identify complex patterns obscure to human financial analysts, thus generating more detailed insights. Here is a rundown of major applications of AI in financial modeling.

Natural language formulas

Automatically creating custom mathematical formulas based on natural language queries to calculate business- or industry-specific financial metrics.

Predictive forecasting

Interpreting financial and operational data and identifying trends to calculate KPIs and predict the outcomes of various business strategies.

Data-based recommendations

Suggesting relevant financial data, parameters, and assumptions that can be used in a financial model; offering budgets, scenarios, cost optimization options, and investment opportunities.

Anomaly detection

Detecting irregularities and unusual patterns in financial data to spot data quality issues and improve the accuracy of financial analysis.

How to choose the best financial modeling software

Due to the diversity of financial modeling tools on the market, companies can find it challenging to find a solution suitable for their business model and company size and meeting their industry-specific requirements. We recommend institutions considering the following aspects when selecting financial modeling software.

Business needs

Analyze the challenges and limitations of your current financial forecasting processes, define the objectives you want to achieve with the new software, and gather feedback from stakeholders to better understand their needs.

Software capabilities

Research the market and shortlist the solutions that cover most of your financial modeling needs. Examine what tools offer additional, nice-to-have functionality that can bring value to your institution.

Security & compliance

Check if the selected software provides necessary security mechanisms accepted in the industry and complies with general and region-specific regulations like GDPR to protect sensitive financial data.

User-friendliness

Prioritize financial modeling platforms that are quick to learn, have user-friendly interfaces, and offer user training materials, enabling your employees to quickly become confident users and easily create financial models.

Pricing

Determine which of the available solutions fits your budget, taking into account the initial implementation costs, licensing fees, and possible extra expenses like adding new features or users.

Scalability

Opt for a financial modeling tool that can support your business growth by accommodating more users and handling larger data volumes while maintaining stable performance.

Get help with implementing financial modeling software

Our financial modeling software services

Backed by 15+ years of experience in financial software development, we help businesses smoothly implement financial modeling software fully aligned with their specific needs.

Consulting

We provide advisory support throughout financial modeling software implementation to help companies minimize technology risks and navigate adoption challenges. Our consultants assist with solution conceptualization, technology selection, project planning and supervision, user training, and other on-demand activities.

Implementation

We deliver financial modeling solutions built from scratch or on top of market-leading platforms, aligning them with your business workflows and strategic plans. From requirements elicitation and architecture design to development, testing, and post-launch support, we handle the implementation process from start to finish.

.jpg)

Rely on financial modeling software for better decision-making

In today’s rapidly changing business environment, traditional spreadsheet-based financial modeling methods pose a risk of delivering inaccurate forecasts while placing an unnecessary burden of manual work on the finance team. Adopting dedicated financial modeling tools helps companies automate multiple analytical processes, create reports faster, and develop realistic financial plans.

If you want to streamline your financial modeling processes, consider turning to Itransition for an expert consultation and smooth software implementation.

.jpg)

FAQs

What companies can benefit from using financial modeling platforms?

Any company that needs to perform budgeting, risk assessment, investment analysis, and strategic planning can use dedicated software to automate the financial modeling processes. Examples include financial institutions, real-estate agencies, ecommerce businesses, and businesses seeking funding.

What are common challenges of implementing financial modeling software?

Businesses should be aware of the following barriers that can hinder successful adoption of financial modeling software.

- Source data integrity issues that can produce erroneous results

- Legacy IT infrastructure that can make integration with the source systems challenging

- Employees’ resistance to give up the old methods of work

- Need for staff training that calls for additional resources

How much does it cost to implement a financial modeling tool?

Vendors typically offer their financial modeling platforms for a monthly fee, the size of which can depend on the available modeling capabilities, the number of users, and the company’s annual revenue. The final cost for a company can also include implementation expenses if the solution is not readily available over the internet and requires developers’ assistance with the setup.

The budget needed to develop a financial modeling solution from scratch varies depending on the software’s complexity, technologies used, integrations, and the development team.

Whichever option you choose, you can contact our consultants for a ballpark estimate of your project.

Service

Financial software development services and solutions

Build a robust fintech software solution according to your business needs. Choose a trustworthy software development company as your tech partner.

Insights

Financial data analytics: applications, benefits & software tools

Explore how financial data analytics software helps businesses assess their financial performance, mitigate risks, and increase profitability.

Insights

Business intelligence for finance: capabilities, tools & integrations

Explore how business intelligence and data analytics benefit the financial services sector and learn what capabilities, integrations, and tools make up a successful BI strategy.

Case study

Trading platform software development

Learn how Itransition developed iOS and Android applications for a European bond trader with over $1 billion raised in funds for their clients.

Case study

BI consulting and engineering for a commercial bank

Find out about Itransition's high-profile BI consulting for a Canadian bank, including data architecture analysis and a BI strategy.

Case study

Loan management solution

Read how Itransition developed a platform for streamlining the entire range of back-office loan management operations.