Salesforce for financial services: features, success stories & payoffs

December 16, 2024

- Home

- CRM services

- Salesforce services

- Salesforce for financial services

by Anton Dynov,

Senior Salesforce Developer

Salesforce provides financial institutions with CRM capabilities to streamline marketing, sales, and service operations, along with specialized features to facilitate industry-specific business processes like mortgage, wealth, and insurance policy management.

As a certified Salesforce Partner, Itransition offers end-to-end Salesforce implementation services to help financial services firms build and adopt Salesforce-based CRM solutions aligned with their unique business goals and industry requirements.

Capabilities of Salesforce Financial Services Cloud for different sectors

Financial Services Cloud (sometimes referred to as FSC) is a CRM solution built on top of Salesforce Sales Cloud and Service Cloud and enhanced with industry-specific features, data models, and workflows to address the finance industry’s needs. Its functional scope includes thematic sets of features that cover customer relationship management operations in the three main sectors of the BFSI macrogroup.

Commercial & retail banking

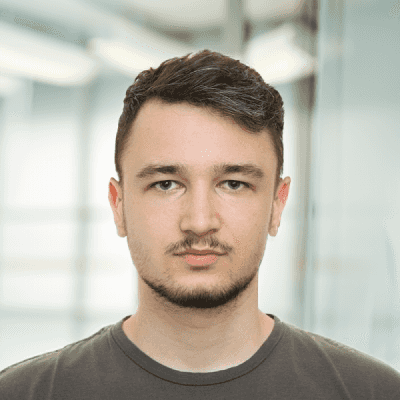

This group of capabilities helps banks streamline and personalize the lending and mortgage lifecycle through the automation of self-service and agent-assisted workflows. These include setting up loan products and application forms, executing credit checks, verifying loan eligibility via qualification rules, making tailored loan product offers, calculating loan payments based on applicant data (income, expenses, etc.) and approving applications. Financial Services Cloud also offers more mainstream CRM features enabling bankers to launch targeted marketing campaigns, facilitate customer onboarding operations like KYC, match customers with suitable banking products, automate document generation, and manage referrals.

Image title: Loan management dashboard

Image source: salesforce.com

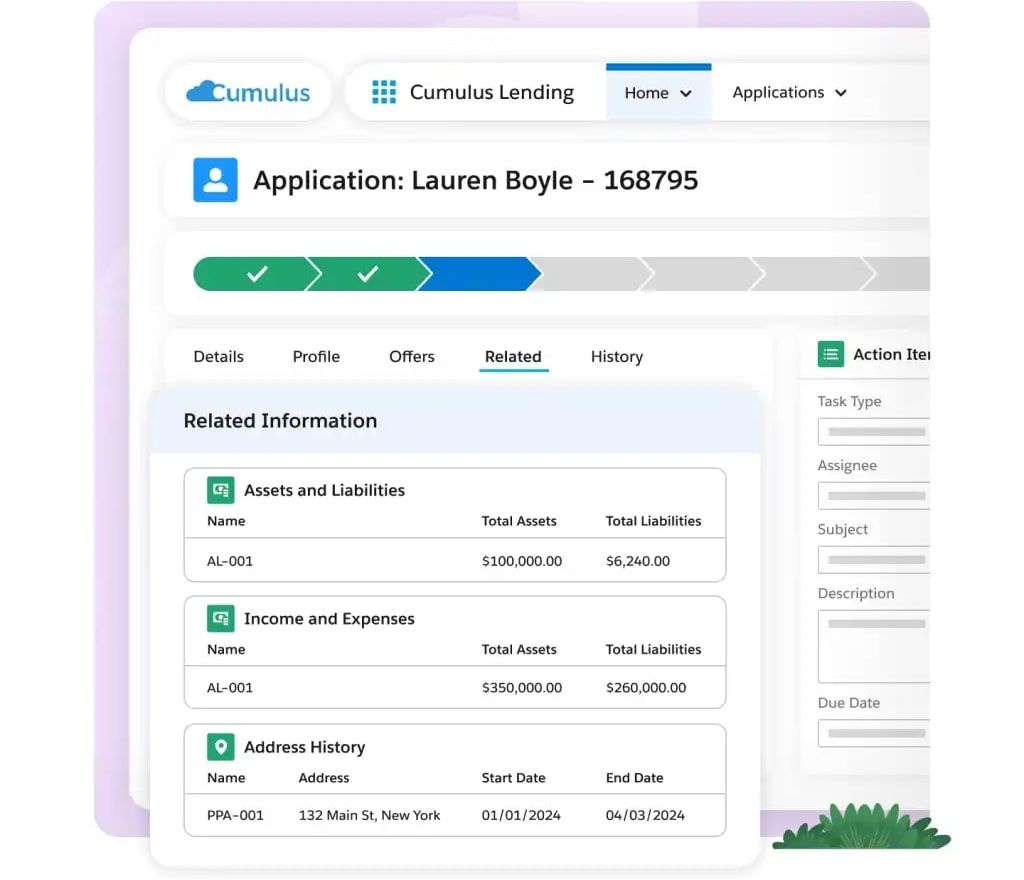

This set of features enables insurers to manage their sales and policies. For instance, it includes a customizable agent console to track sales performance by policy type, monthly renewals, and other KPIs. Agents can also use interest tags to classify prospects according to their interest in certain insurance products. Furthermore, Salesforce provides a policy management component to monitor an account’s policies and related claims, along with an event component to track key events in policyholders’ lives (such as a car purchase) and create contextual actions (for instance, offering auto insurance). Finally, Salesforce helps streamline and automate insurance underwriting tasks, including premium calculation, quote configuration, and claims processing operations like FNOL intake.

Image title: Insurance claim form

Image source: salesforce.com

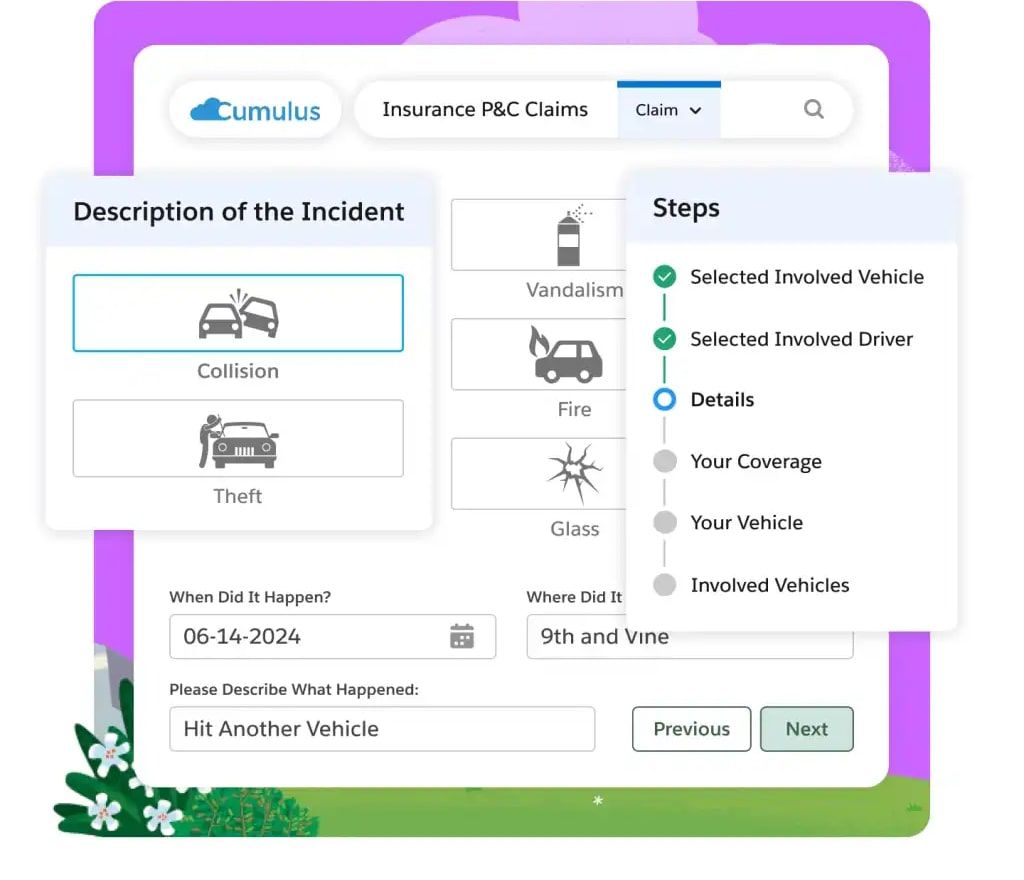

Wealth & asset management

Financial Services Cloud provides wealth and asset managers with specialized capabilities to deliver more effective advisory services. These professionals can get a full view of each customer’s financial accounts, goals, relationships, and life events or milestones, segment clients accordingly, and offer personalized advice. Additionally, the solution enables advisors to provide proactive, data-driven financial assistance and expand their referral networks.

Image title: Wealth management dashboard

Image source: salesforce.com

Searching for an expert partner for your Salesforce project?

Useful Financial Services Cloud functionality for all sectors

Financial Services Cloud complements its sector-specific capabilities with an extensive range of features that can be useful for any type of BFSI organization.

Actionable Segmentation

to group similar client profiles into segments and engage them with tailored outreach initiatives

Branch Management

to monitor activities and performance of various branches of your business and assign customer records to certain branches

Business Client Engagement

to capture details like controlling parties and business structure for easier onboarding, including screening check processes

Complaint Management

to help service agents capture, submit, and track client complaints via prebuilt dashboards

Financial Accounts Summary

to effectively address customer queries through a unified view of accounts, transactions, and record alerts

Financial Deal Management

to record deal terms, stage, confidentiality level, and other information and share it with relevant stakeholders

Financial Plans & Goals

to track customers’ financial goal progress based on their financial accounts

KYC data model

to facilitate identity verification, risk assessment, and screening checks of accounts, contacts, and leads

Record Rollups

combining customer data across all their records and accounts, including insurance policies, bank accounts, and investment accounts

Related add-ons & tools for Financial Services Cloud

Experience Cloud

is a Salesforce product that offers pre-built templates to easily create websites and digital communities, including client portals for self-service loan applications and partner sites for sharing financial account details with independent advisors.

CRM Analytics

is a Financial Services Cloud add-on featuring AI-powered intelligence capabilities like customer churn prediction or account asset growth recommendations.

Data Cloud

namely Salesforce’s data management platform, integrates interaction, behavioral, and transactional data from various channels to provide a unified view of your clients. It also includes a data model specifically for Financial Services Cloud.

MuleSoft

is an integration platform by Salesforce providing pre-built APIs and connectors to exchange data between Financial Services Cloud and other systems.

Salesforce Shield

is a set of security tools, such as data encryption and event monitoring, to protect confidential client data and ensure regulatory compliance.

Transition Assistant

is a free tool that helps financial firms requiring a more specialized CRM to migrate from their standard Salesforce org to Financial Services Cloud, facilitating processes like gap analysis and data model mapping.

Upcoming Financial Services Cloud updates

In winter 2025, Salesforce will add new capabilities to Financial Services Cloud, including advanced AI features powered by Einstein.

Banking & wealth management

- AI Autofill for Complaints

to auto-populate case titles and descriptions with data collected from phone calls and chats, speeding up the intake of complaints

- Auto-Generated Complaint Summaries

to review complaint-related communications faster

- AI client summaries

providing wealth advisors with a succinct outline of a customer’s financial status, plans, goals, life events, and relationships

- Contextual Alerts

to notify bankers and wealth advisors on cash flows, large expenses, goal achievements, and other occurrences

- Wealth Management Fact Finding

to assess clients’ needs, for instance in terms of risk tolerance, and provide tailored financial advice

Insurance

- Account & claims summaries

instantly generated with AI based on available business data

- Data Cloud for Insurance

to consolidate data from policies and claims and target policyholders with automated and personalized customer engagement actions

Sector-agnostic releases

- Business Relationship Plans

created via pre-built templates to get a 360-degree view of your clients and their business performance and identify potential opportunities

- Client insights

gathered from stakeholders to develop effective business strategies in line with customer goals

Industry-agnostic Salesforce products for financial services institutions

Sales Cloud and Service Cloud are generic products that serve as the foundation for Financial Services Cloud. Together with Marketing Cloud, they represent the cornerstone of Salesforce’s CRM offering and cover the three main customer-oriented business functions. BFSI firms can mix Financial Services Cloud users and generic Cloud users in the same Salesforce Org, for instance, if they need access to marketing-specific capabilities.

Marketers can use this product to launch targeted campaigns, engage their audience with website or in-app journeys personalized in real time, monitor marketing KPIs, and receive AI-powered suggestions to optimize their media plans. Marketing Cloud also includes automation capabilities to speed up lead segmentation, engagement message sending, and other tasks.

This product can help organizations drive engagement through virtual buyer assistants and automated follow-ups, streamline the revenue lifecycle via CPQ features and automated payment collection, and boost sales team productivity with real-time deal alerts and account planning templates. Additionally, the solution offers analytical tools such as KPI dashboards, sales forecasts, and AI-powered recommendations for best next sales actions.

This solution enables companies to mitigate support workloads through automated case distribution, AI chatbots, and self-service help centers. Furthermore, it provides support specialists with multiple tools to work more efficiently, including AI-generated knowledge article recommendations for faster case resolution, embedded telephony and live chat to provide multi-channel assistance, and conversation mining to identify common contact reasons.

Real-life examples of Salesforce adoption in finance

+75%

client management productivity

Salesforce CRM for an insurance buyout agency

A financial firm specializing in insurance payment buyouts teamed up with Itransition to implement a Salesforce-based CRM system, aiming to streamline and automate customer-oriented processes previously handled in Excel. The resulting solution combines out-of-the-box features with custom pages, components, and workflows to help the company store client information (payments, follow-up deadlines, etc.), track leads and opportunities, calculate annuity payments, and generate accurate quotes.

4x

increase in customer conversations per day

Salesforce-powered digital platform for Santander UK

The UK subsidiary of Banco Santander adopted a Salesforce-based platform to provide business customers with consulting services focusing on international expansion. The solution, called Santander Navigator, enables the bank to centralize customer interaction and registration data into a unified CRM record, identify their challenges and opportunities, and offer tailored advisory. Additionally, the organization uses this data to send relevant event invitations and communications to subscribers via Marketing Cloud. At the same time, subscribers can interact with relationship managers, trade experts, and peers through a community forum hosted on Experience Cloud.

Weeks → 24 min

client onboarding time reduction

Salesforce-based wealth management CRM for RBC

The wealth management division of RBC Capital Markets chose Salesforce to integrate customer data stored in multiple legacy systems into a unified CRM solution via MuleSoft and protect it with Shield’s encryption capabilities. The new system features automated case management workflows to streamline client onboarding, a customer portal for self-service access to the respective accounts, and an analytics dashboard enabling financial advisors to monitor their cases and portfolios. Advisors can also receive AI-powered customer insights and recommendations, such as contacting a priority client, to best serve their accounts.

60%

service case deflection rate

Salesforce-enabled service platform for PenFed

US federal credit union PenFed implemented a platform based on Financial Services Cloud to boost contact center efficiency and deliver timely assistance. The solution consolidates members’ account data from multiple systems with MuleSoft, providing service specialists with consistent, up-to-date information to address customer requests or handle tasks like credit checks more effectively. Furthermore, the organization can now leverage Salesforce features like Einstein Bots to automate routine support cases, self-service options enabling clients to access account balances or other information, and a live chat to further expand customer communication channels.

+75%

client management productivity

Salesforce CRM for an insurance buyout agency

A financial firm specializing in insurance payment buyouts teamed up with Itransition to implement a Salesforce-based CRM system, aiming to streamline and automate customer-oriented processes previously handled in Excel. The resulting solution combines out-of-the-box features with custom pages, components, and workflows to help the company store client information (payments, follow-up deadlines, etc.), track leads and opportunities, calculate annuity payments, and generate accurate quotes.

4x

increase in customer conversations per day

Salesforce-powered digital platform for Santander UK

The UK subsidiary of Banco Santander adopted a Salesforce-based platform to provide business customers with consulting services focusing on international expansion. The solution, called Santander Navigator, enables the bank to centralize customer interaction and registration data into a unified CRM record, identify their challenges and opportunities, and offer tailored advisory. Additionally, the organization uses this data to send relevant event invitations and communications to subscribers via Marketing Cloud. At the same time, subscribers can interact with relationship managers, trade experts, and peers through a community forum hosted on Experience Cloud.

Weeks → 24 min

client onboarding time reduction

Salesforce-based wealth management CRM for RBC

The wealth management division of RBC Capital Markets chose Salesforce to integrate customer data stored in multiple legacy systems into a unified CRM solution via MuleSoft and protect it with Shield’s encryption capabilities. The new system features automated case management workflows to streamline client onboarding, a customer portal for self-service access to the respective accounts, and an analytics dashboard enabling financial advisors to monitor their cases and portfolios. Advisors can also receive AI-powered customer insights and recommendations, such as contacting a priority client, to best serve their accounts.

60%

service case deflection rate

Salesforce-enabled service platform for PenFed

US federal credit union PenFed implemented a platform based on Financial Services Cloud to boost contact center efficiency and deliver timely assistance. The solution consolidates members’ account data from multiple systems with MuleSoft, providing service specialists with consistent, up-to-date information to address customer requests or handle tasks like credit checks more effectively. Furthermore, the organization can now leverage Salesforce features like Einstein Bots to automate routine support cases, self-service options enabling clients to access account balances or other information, and a live chat to further expand customer communication channels.

+75%

client management productivity

Salesforce CRM for an insurance buyout agency

A financial firm specializing in insurance payment buyouts teamed up with Itransition to implement a Salesforce-based CRM system, aiming to streamline and automate customer-oriented processes previously handled in Excel. The resulting solution combines out-of-the-box features with custom pages, components, and workflows to help the company store client information (payments, follow-up deadlines, etc.), track leads and opportunities, calculate annuity payments, and generate accurate quotes.

4x

increase in customer conversations per day

Salesforce-powered digital platform for Santander UK

The UK subsidiary of Banco Santander adopted a Salesforce-based platform to provide business customers with consulting services focusing on international expansion. The solution, called Santander Navigator, enables the bank to centralize customer interaction and registration data into a unified CRM record, identify their challenges and opportunities, and offer tailored advisory. Additionally, the organization uses this data to send relevant event invitations and communications to subscribers via Marketing Cloud. At the same time, subscribers can interact with relationship managers, trade experts, and peers through a community forum hosted on Experience Cloud.

Weeks → 24 min

client onboarding time reduction

Salesforce-based wealth management CRM for RBC

The wealth management division of RBC Capital Markets chose Salesforce to integrate customer data stored in multiple legacy systems into a unified CRM solution via MuleSoft and protect it with Shield’s encryption capabilities. The new system features automated case management workflows to streamline client onboarding, a customer portal for self-service access to the respective accounts, and an analytics dashboard enabling financial advisors to monitor their cases and portfolios. Advisors can also receive AI-powered customer insights and recommendations, such as contacting a priority client, to best serve their accounts.

60%

service case deflection rate

Salesforce-enabled service platform for PenFed

US federal credit union PenFed implemented a platform based on Financial Services Cloud to boost contact center efficiency and deliver timely assistance. The solution consolidates members’ account data from multiple systems with MuleSoft, providing service specialists with consistent, up-to-date information to address customer requests or handle tasks like credit checks more effectively. Furthermore, the organization can now leverage Salesforce features like Einstein Bots to automate routine support cases, self-service options enabling clients to access account balances or other information, and a live chat to further expand customer communication channels.

Salesforce adoption benefits for finance

Optimized storage of financial data

such as loan applicant employment or insurance product coverage, due to the availability of industry-specific data models and respective objects and fields

Seamless financial process automation

via pre-built workflows for mortgage applications, insurance claims processing, and other industry-specific procedures

Intuitive access to financial data

and other relevant information with features like insurance agent consoles or complaint management dashboards

Ensured regulatory compliance

with features like Shield for data encryption and Compliant Data Sharing controlling how financial data is shared across your organization

Enhanced decision-making & operational efficiency

due to AI capabilities providing actionable insights and automating complex financial processes, including next-best action recommendations and service chatbots

Multiple integration options

such as pre-built connectors on MuleSoft or the AppExchange marketplace, to ensure data consistency and a unified customer view

Extensive customization possibilities

including AppExchange extension packages and no-code customization tools, to modify out-of-the-box Salesforce functionality

Our Salesforce services for finance

.jpg)

- Audit of your current CRM solution, if any

- Outline of the new CRM’s functional and non-functional requirements

- Salesforce edition and feature set selection

- Implementation project roadmapping and budgeting

- Configuration, customization, and integration advisory

- User training and support

- Salesforce configuration and customization

- Integration with your software ecosystem

- QA and user acceptance testing

- Salesforce deployment to production

- Data migration from your legacy CRM and other systems to Salesforce

Implement your Salesforce solution with Itransition’s guidance

A solid choice to meet your CRM needs

Does your company need to consolidate personal data to tailor each customer experience and strengthen client relationships while keeping sensitive information secure in a regulated vertical like finance? Salesforce promises to meet these contrasting needs thanks to a vast selection of customer- and compliance-oriented capabilities.

That said, what sets Salesfrom apart from other competitors is its sheer amount of features specifically designed for the financial services industry, making it an extremely flexible and comprehensive CRM solution. Team up with an experienced partner like Itransition to implement Salesforce seamlessly and make the most of this popular platform.

Insights

CRM software for financial services: functionality, best platforms & guidelines

Discover finance CRM’s capabilities, payoffs, best solutions on the market, and selection factors, along with Itransition’s range of services.

Service

Banking CRM

Itransition develops banking CRM software for both retail and corporate banks and provides solutions for enabling full-scale financial ecosystems.

Service

Financial software development services and solutions

Build a robust fintech software solution according to your business needs. Choose a trustworthy software development company as your tech partner.

Insights

Financial data analytics: applications, benefits & software tools

Explore how financial data analytics software helps businesses assess their financial performance, mitigate risks, and increase profitability.

Insights

Business intelligence for finance: capabilities, tools & integrations

Explore how business intelligence and data analytics benefit the financial services sector and learn what capabilities, integrations, and tools make up a successful BI strategy.

Case study

Loan management solution

Read how Itransition developed a platform for streamlining the entire range of back-office loan management operations.