CRM software for financial services: functionality, best platforms & guidelines

December 9, 2025

- Home

- CRM services

- CRM software for financial services

Head of Salesforce Practice,

Head of Microsoft CRM Practice

Finance CRM systems offer comprehensive capabilities that facilitate marketing, sales, and service operations and streamline industry-specific processes like loan, portfolio, and insurance policy management, enabling financial services companies to serve clients better and drive revenue growth.

As an IT company providing CRM consulting services for 10+ years, Itransition helps financial institutions implement customer relationship management software tailored to their unique business needs.

Key features of financial services CRM

Facilitate lead generation and nurturing with:

- Lead capture from multiple touchpoints

- Lead segmentation into cohorts

- Lead ranking and prioritization

- Targeted social media and email marketing

- Marketing automation (posting, content generation, etc.)

Sales management

Boost lead conversion, cross-selling, and upselling thanks to:

- Sales pipeline management (task planning, prospect progress tracking, etc.)

- Sales process automation (follow-ups, task assignment, etc.)

- Revenue management, including dynamic pricing

- Sales contract management

- Sales quota and commission management

- Multi-channel customer communication

Service management

Improve customer experience to maximize their retention and lifetime value via:

- Streamlined case management with automated assignment, escalation, etc.)

- Self-service customer portals

- Knowledge bases for service agents

Contact management

Better engage and serve your customers through a comprehensive view of their data, including:

- Detailed customer and partner profiles

- Client interaction history tracking

- Contact information search and retrieval

Document management

Streamline document processing and clerical workflows via:

- Secure legal and financial document storage

- Document templates

- Automated generation of documents and forms

- Document collaboration (coediting, commenting, etc.)

Analytics & reporting

Optimize your CRM processes and strategies and deliver more personalized financial services with:

- Customer analytics (sentiment analysis, CLV calculation, etc.)

- Ad campaign analytics

- Sales analysis and forecasting

- Sales and service team KPI tracking

Security & compliance management

Ensure secure data storage and access through:

- Cybersecurity features (IAM, SIEM, data encryption, data residency control, multi-factor authentication, user activity monitoring, etc.)

- Compliance with data management and security regulations specific to the finance industry and geographic region (PCI DSS, PSD2, GDPR, SOX, etc.)

- KYC and risk assessment capabilities to prevent fraud

Looking for a CRM implementation partner?

CRM functionality for financial institutions

Commercial banks

Commercial banks should look for the following features in their financial CRM solution:

- Banking products and services personalization based on customers’ preferences and other data

- Loan lifecycle automation, including tracking repayments and sending mortgage restructuring offers

- Capture, investigation, and resolution of transaction disputes and other claims

Investment services providers

Financial advisors, wealth and asset management companies, brokerages, and investment banks should opt for CRM software offering tools like:

- Financial plans and investment portfolios personalization in line with clients’ trading histories, risk propensity, and other traits and metrics

- Portfolios’ composition (stocks, bonds, and other assets), current value, and performance monitoring

- Customers’ financial goal progress tracking

Insurance agencies

Insurance companies should opt for a CRM system with capabilities like:

- Recommendation of insurance products with coverage options based on customers’ preferences

- Policy administration workflow automation, such as quoting, billing, policy payment scheduling, renewal, and commission calculation

- Claims management automation, including intake, data extraction from FNOL, coverage verification, and settlement

Common finance CRM integrations

Financial institutions should integrate their CRM software solution with other corporate systems or third-party services to streamline client data entry and exchange.

to gather customer information on accounts, loans, credit cards, and transactions and provide more personalized banking services

to facilitate policy administration, underwriting, and other insurance-specific operations based on comprehensive and up-to-date client information

financial databases

ERP software

to ensure consistency of customer and operational data and harmonize your CRM operations with other corporate functions

to collect customer data for easier quoting, invoicing and revenue sources monitoring

Payment gateways

to track and process financial transactions like loan and insurance premium payments

Telephony apps

to make and receive calls directly from the CRM, facilitating customer interactions

Project management systems

to plan marketing or sales projects and tasks and boost team collaboration across departments

Best CRM software for the financial services industry

Over the past decade, Salesforce has been the most popular all-in-one CRM platform thanks to a combination of industry-agnostic products for marketing, service, and sales teams and specialized tools for various verticals. The latter include Salesforce Financial Services Cloud, a CRM solution with standard functionality expanded to meet the requirements of the BFSI sector.

Key strengths & capabilities

- Actionable Segmentation to classify similar client profiles into segments and target them with personalized outreach initiatives

- Financial Accounts Summary for a unified view of accounts, transactions, and record alerts to address customer queries more effectively

- Financial Deal Management to record deal terms, status, confidentiality level, and other details and share information with relevant stakeholders

- Financial Plans and Goals feature to monitor clients’ financial goal progress based on their respective financial accounts

- KYC data model to streamline identity verification and risk assessment of accounts, contacts, and leads

- Transaction Dispute Management features like guided intake forms and banking system integration to facilitate the capture and submission of customer disputes

- Insurance Policy Administration to automate policy management workflows, including quoting, issuance, billing, premium calculation, renewal, and commission management

- Insurance Product Administration to manage your catalog of products and establish eligibility rules and coverage terms

- Insurance Claims Management enabling omni-channel intake, rule-based automated adjudication, and payment initiation via third-party gateways

Limitations

Complex modular licensing with pricey top-tier plans and a steep learning curve

Pricing

- Three plans for Financial Services Cloud starting at $325 per user per month

- Multiple plans for core Salesforce products (Marketing, Sales, and Service Cloud) starting at $25 per user per month

- Pricing for other products and add-ons available on the Salesforce website

- 30-day free trial

Dynamics’ functional scope extends beyond the generic customer-focused capabilities of a traditional CRM system and encompasses industry-specific tools for financial service providers, as well as ERP capabilities and features for accounting, HR, and other business functions.

Key strengths & capabilities

- Unified customer profile for retail banking and wealth management summarizing investment portfolios, financial holdings, household finances, and other information

- Investment portfolios component detailing the current value of individual portfolios, lifetime gain, and performance in various time frames

- Life events and goals functionality highlighting clients’ past and expected life milestones to identify opportunities and provide personalized financial offers

- Loan onboarding features to streamline lending processes, including loan application summaries and task management for lending professionals

- Document intelligence to track, manage, and confirm documentation for various onboarding scenarios, such as bank account opening

- Creation of personalized customer journeys with content, messages, and recommendations adjusted in real time based on personal data

- Sales management capabilities to plan and track sales tasks, prioritize leads and opportunities, and monitor sales KPIs

- Case management functionality, including automated routing, AI-generated customer responses, and customer support chatbots

Limitations

Complex UX and issues with third-party services integration

Pricing

- Different plans for each product (Marketing, Sales, Service, etc.)

- Detailed licensing guide available on the Microsoft website

- 30-day free trial

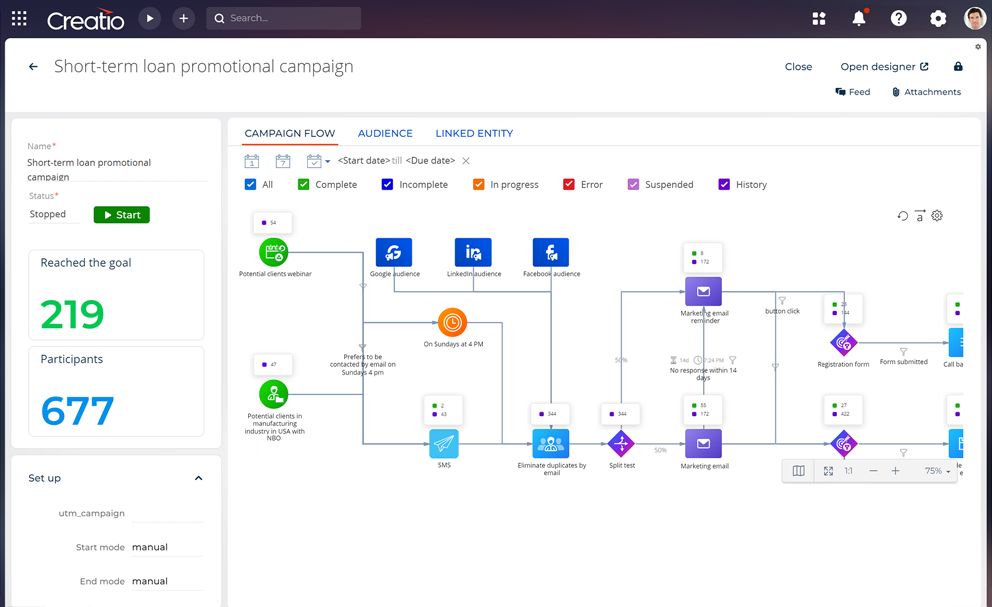

Creatio’s range of solutions includes three CRM products for marketing, sales, and customer service, ready-to-use workflow templates for finance and other industries, and a no-code development platform to build CRM applications.

Image title: Creatio’s marketing campaign management dashboard

Image source: creatio.com — One platform to automate banking workflows and CRM with no-code

Key strengths & capabilities

- Audience segmentation and campaign management to engage leads and customers with personalized communications

- Sales management to capture leads, make personalized proposals via next-best-offer intelligence, and manage daily sales activities

- Front-office workflow automation capabilities to facilitate customer onboarding, account opening, mortgage consultations, and other services

- Loan management to offer personalized loan terms and automate loan processes like application data verification and debt collection

- Insurance policy administration to consolidate policy data and automate policy management workflows, including risk management

- Underwriting functionality to facilitate and automate the review and approval of loan, mortgage, or insurance applications based on available data

- Customer support capabilities to automatically collect, assign, and investigate cases, including insurance claims and bank disputes, for faster resolution

- Compliance-focused features to centralize customer profile data for KYC operations and automate identity verification for fraud prevention

Limitations

Limited advanced analytics and AI-driven capabilities

Pricing

- Composable pricing based on the plan, products, and number of users selected

- Pricing calculator available on the website

- 14-day free trial

Vymo is a mobile-first, user-friendly sales engagement platform geared towards the needs of financial institutions. Its offering encompasses three finance-oriented products for lead, activity, and partner management, along with two CRM solutions for banks and insurance companies.

Key strengths & capabilities

- Loan management to facilitate lending processes, including initial prospecting, customer onboarding, and loan disbursal

- Delinquency management and debt collection features covering risk assessment, field collections, tele-calling, and digital outreach

- Prospect and customer management capabilities to assist insurance agents with prospecting, client engagement, servicing, renewals, and other tasks

- Bancassurance functionality enabling insurers to collaborate with partnering bank branches and engage a broader customer base

- Lead management to aggregate leads from different sources, allocate them to suitable agents, and identify next best actions to convert them

- Sales activity management to track calls, meetings, emails, or other engagement initiatives and monitor sales performance

Limitations

Undisclosed pricing

Pricing

Price upon request

Finance CRM platform selection factors

Prioritize these key aspects to identify the finance CRM solution best suited to your organization:

Capabilities

- Features:

Out-of-the-box functionality, including finance-oriented capabilities, that fully meets your business needs

- Customization options:

Possibility of modifying off-the-shelf functionality (entities, fields, forms, workflows, etc.) via low-code/no-code customization tools, development frameworks, and extension packages to manage finance-specific data and processes

- Integrations:

Pre-built connectors or tools for custom API creation to facilitate integration with other systems or services

- Mobile CRM:

Ease of use across various mobile devices, possibly via a dedicated app

- Scalability:

Ability to handle increased traffic, data flows, and processes without performance issues as your user base grows

Reliability

- Cybersecurity:

Robust security features to minimize the risk of data breaches or leaks

- Compliance:

Strict adherence to relevant security standards and regulations

Deployment

- Cloud:

Cloud-based hosting of the platform is optimal in terms of agility, scalability, service availability, etc.

On-premises:On-premises hosting allows companies to install CRM on their local servers for more control over functionality, updates, and security

Terms & conditions

- Pricing:

Convenient model (per-user, flat-fee, tiered by features, etc.) for your usage scenario

- Free trials:

Possibility to test the platform and collect user feedback

- Services:

Ongoing maintenance, timely user support, and regular software updates provided by the vendor

- Specific clauses:

Additional costs for premium services, contractual obligations causing vendor lock-in, etc.

Benefits of finance CRM for business growth

Data-driven decision making

- Holistic view of your customers, including their financial goals, preferences, and specific needs via unified profiles

- Management of all customer-related data and CRM processes in a single tool

Superior operational efficiency

- Optimization of your sales representatives’ workloads via lead and opportunity prioritization

- Streamlined business processes through the elimination of manual data entry across spreadsheets and automation of routine, repetitive tasks

Increased revenues

- Improved lead generation with segmentation, targeted marketing, and omnichannel engagement

- Maximized lead conversion via lead ranking, sales automation, and tailored offers generation

- Enhanced financial service profitability through effective pricing strategies

Stronger client relationships

- Improved customer satisfaction with personalized financial service offers

- Increased customer retention and loyalty through efficient support and faster case resolution

Seamless collaboration

- A shared view of each customer for marketing, sales, and service team members

- Better cross-department coordination via effective task planning throughout the customer journey

- Business needs elicitation and CRM strategy creation

- Audit of your software ecosystem and existing CRM, if any

- Solution conceptualization and tech stack selection

- Data governance and management consultancy

- CRM platform selection and license optimization

- Project planning and budgeting

- Custom CRM development or platform configuration and customization supervision

- CRM migration planning and backup strategy definition

- User training and onboarding

CRM implementation

- CRM architecture design

- Front-end and back-end development or CRM platform customization, configuration, and workflow setup

- CRM integration with your software ecosystem

- End-to-end QA and testing

- CRM deployment to the production environment

- Data migration from your legacy CRM to the new one

- Software maintenance and troubleshooting

Strengthen customer relationships with a CRM solution by Itransition

Customer visibility & data security combined

Service

Financial software development services and solutions

Build a robust fintech software solution according to your business needs. Choose a trustworthy software development company as your tech partner.

Case study

Salesforce CRM for a US insurance buyout agency

Learn how Itransition’s customized Salesforce CRM has brought a US insurance buyout agency 54% more leads.

Insights

Business intelligence for finance: capabilities, tools & integrations

Explore how business intelligence and data analytics benefit the financial services sector and learn what capabilities, integrations, and tools make up a successful BI strategy.

Case study

Loan management solution

Read how Itransition developed a platform for streamlining the entire range of back-office loan management operations.

Insights

Financial data analytics: applications, benefits & software tools

Explore how financial data analytics software helps businesses assess their financial performance, mitigate risks, and increase profitability.

Case study

Trading platform software development

Learn how Itransition developed iOS and Android applications for a European bond trader with over $1 billion raised in funds for their clients.

_0.jpg)