Predictive analytics in finance: use cases, platforms & adoption guidelines

October 21, 2025

- Home

- Predictive analytics

- Predictive analytics in finance

Head of AI/ML Center of Excellence

With holistic expertise in AI, predictive analytics consultants from Itransition can help you build and implement advanced software solutions to predict future financial outcomes and make more informed decisions for your business.

Table of contents

Financial data analytics market trends

the financial analytics market size in 2025

Mordor Intelligence

of finance functions will be using AI analysis with for real-time decision making by 2028

Gartner

of financial institutions use predictive AI for risk, fraud, operations, or compliance

Institute of International Finance

Key predictive analytics use cases in finance

Brokerages, hedge funds, and other firms use AI-powered wealth management tools, stock trading software and financial analytics platforms featuring predictive capabilities to optimize their trades and portfolio investments. Powered by machine learning decision trees based algorithms and neural networks, these tools can process financial data in real time to predict changes in stock prices and other market trends based on various economic indicators. This enables investment and trading companies to identify the most promising stocks, bonds, and commodities and build more balanced portfolios. Financial firms can also combine algorithmic trading with predictive analytics for smarter trade order automation.

Budgeting & accounting

provide finance teams with capabilities like sales and expense analysis and cash flow forecasting for more accurate financial planning and resource allocation. For instance, these solutions can monitor the cash conversion cycle, internal rate of return by region, and other indicators to provide accountants with detailed reports on the company’s future financial performance and recommend budgeting strategies to achieve specific financial goals.

Marketing & sales personalization

Predictive analytics is changing the way financial organizations and, more specifically, their marketing and sales teams engage with prospects or clients, enabling a hyper-personalized customer experience. This means, for instance, helping monitor customer behavior on social media and other digital channels to identify their needs and interests, segment them accordingly, and target them with tailored financial product offers and recommendations.

Credit scoring

Mortgages, credit cards, and other types of loans always involve some default risk. Predictive analytics solutions can mitigate it by calculating clients’ creditworthiness based on their credit inquiries, available liquidity, disposable income, tax returns, payment history, and other factors and suggesting high-value solvent customers. These tools can also complement individual customer assessments with data on current market conditions and competitor offerings to help banks and mortgage companies estimate an appropriate credit limit and interest rate.

Fraud detection & prevention

Preventing fraud is one of the main reasons for artificial intelligence implementation in financial organizations. Indeed, predictive anomaly detection systems powered by machine learning algorithms can spot suspicious trading patterns or transactions to help prevent market manipulation and money laundering. Furthermore, ML-based fraud detection solutions can identify anomalous credit card account behaviors to mitigate the potential risk of payment fraud.

Turn data into valuable insights with Itransition’s predictive analytics solutions

Real-life examples of predictive analytics in finance

A major financial institution partnered with PwC to incorporate a predictive analytics tool into their budget forecasting framework. The solution helped the client forecast the impact of internal or external events on cash flows, from high-level economic trends to individual disbursements. As a result, the client was able to extend the forecast period from 3 to 12 months, free up employee time for value-added activities, and make more accurate budget decisions.

One of the largest banks in the United States implemented a fraud detection engine with predictive capabilities from DataVisor to accurately assess the likelihood of fraud across a range of transactions and other operations, from card purchases to loan applications. After deployment, DataVisor’s solution improved successful interceptions of fraud attempts in online loan applications by 30% and achieved a false-positive rate of just 1.3%.

Carbon, an African digital bank, chose DataRobot’s cloud-based AI platform to automatically assess customers’ credit risk. The ML-based system collects data from first-, second-, and third-party sources to create a credit score, allowing customers with higher scores to access better rates. The solution also estimates default risk for each customer, which is then used to adjust loan terms. Carbon reported that their team would need 25% more members to perform the same tasks manually.

A multinational bank adopted Teradata's cloud data analytics platform to foster customer acquisition and engagement. The bank can now identify potential clients with a high level of interest in their services prior to starting an application based on their web page visit durations and other website KPIs. It can also target high-value prospects with personalized messages based on past transactions and interactions across digital channels. As a result, the institution increased the click-through rate of their personalized messages by 50 times.

Best predictive analytics platforms for finance

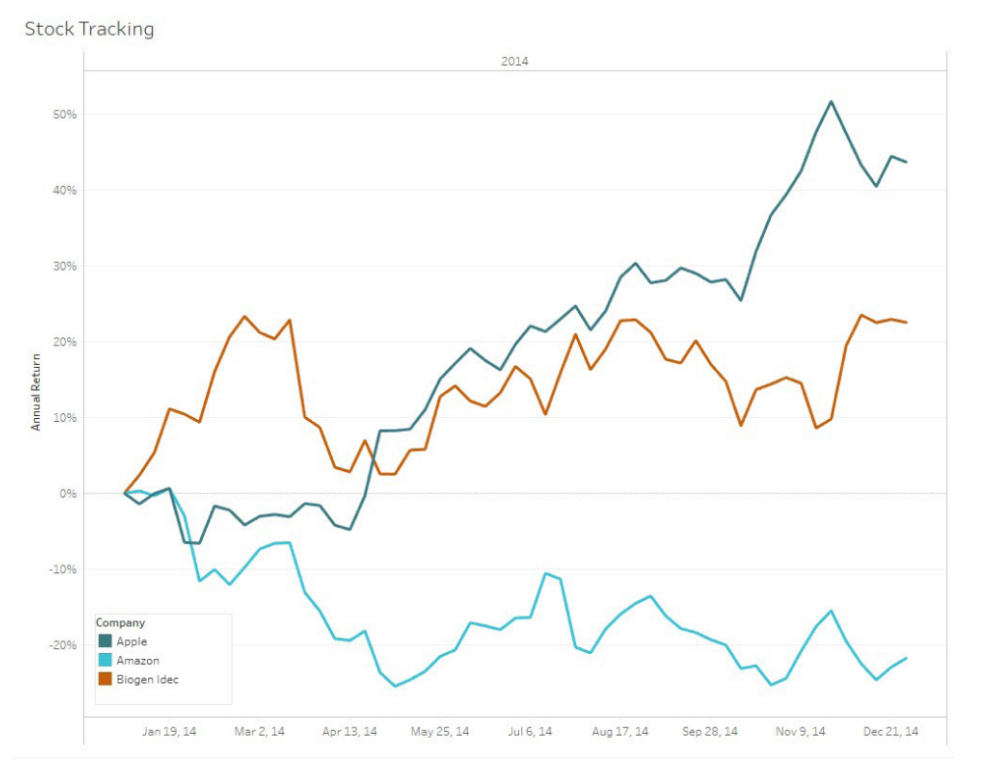

Tableau is a popular BI, analytics, and visualization tool by Salesforce providing self-service data preparation, guided machine learning model building, and other user-friendly features for seamless analysis. The platform also offers predictive analytics capabilities powered by linear regression algorithms to help forecast multiple financial scenarios, from sales trends to stock market price fluctuations.

Pricing

- Free trial

- Three plans starting from $35 user/month

Image title: Tableau’s feature for time series analysis of stock prices

Image source: tableau.com — Advanced Analytics with Tableau

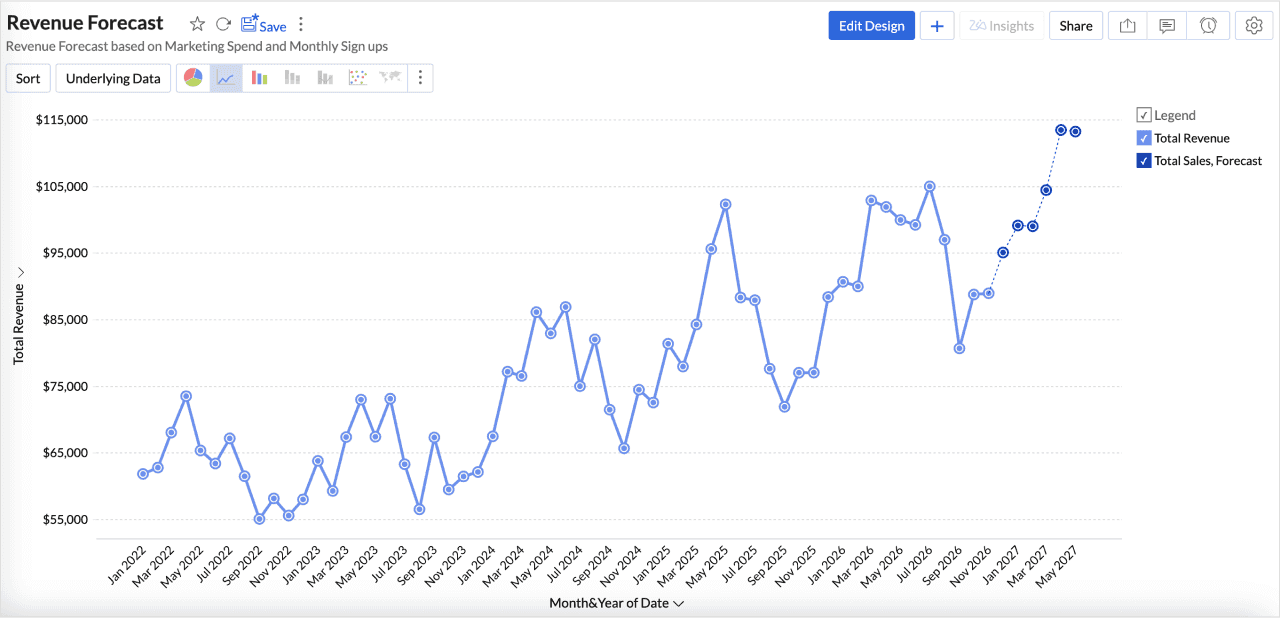

Zoho Analytics is a self-service BI and analytics platform powered by forecasting algorithms and natively integrated with the Zoho Finance suite of business apps. The solution enables companies to analyze their financial and accounting data, predict business performance indicators like sales and revenues, and visualize these insights through interactive dashboards.

Pricing

- 30-day free trial

- Multiple plans across cloud and on-premises deployments

- Free basic plan for the on-premises version

Image title: Zoho’s revenue forecast dashboard

Image source: zoho.com — Forecasting

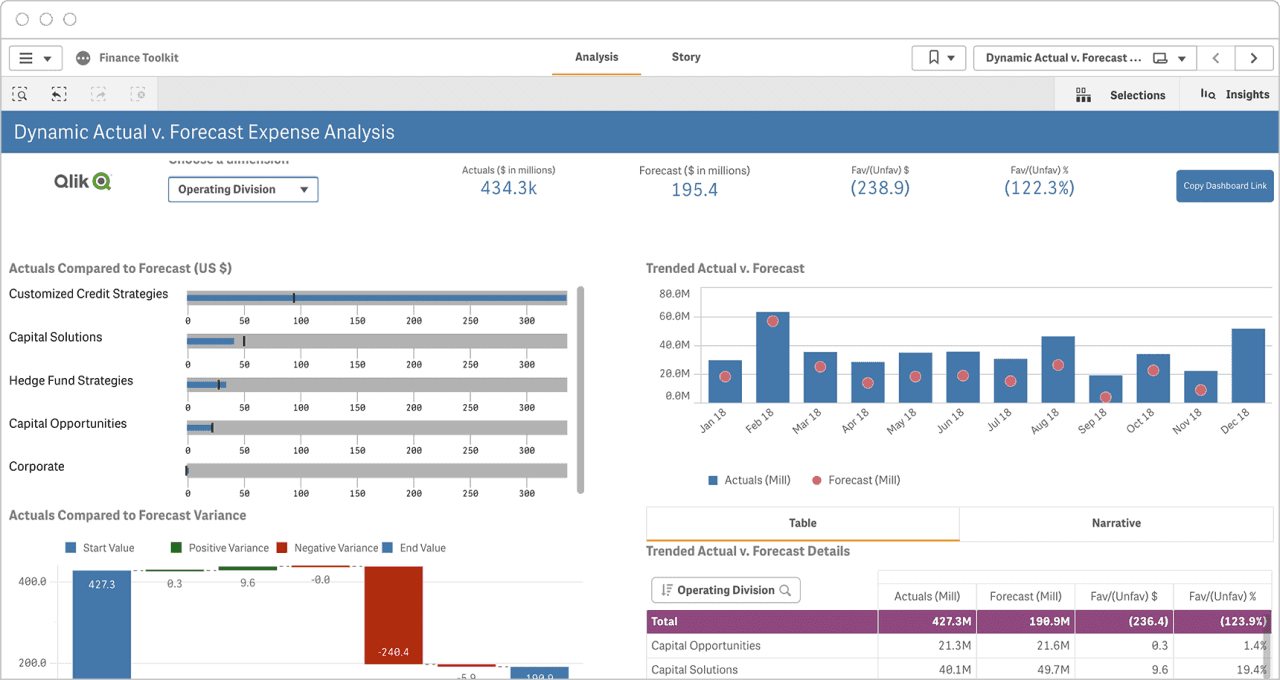

Qlik Sense is an augmented analytics platform featuring AI-assisted data preparation, natural language querying, and predictive analytics capabilities. This advanced solution enables decision-makers to generate forecasts and run simulations via what-if scenarios, facilitating financial planning, revenue and profitability management, and expense management.

Pricing

- Free trial

- Four plans starting at $200/month

Image title: Qlik’s expense forecasting tool

Image source: qlik.com — Financial Analytics

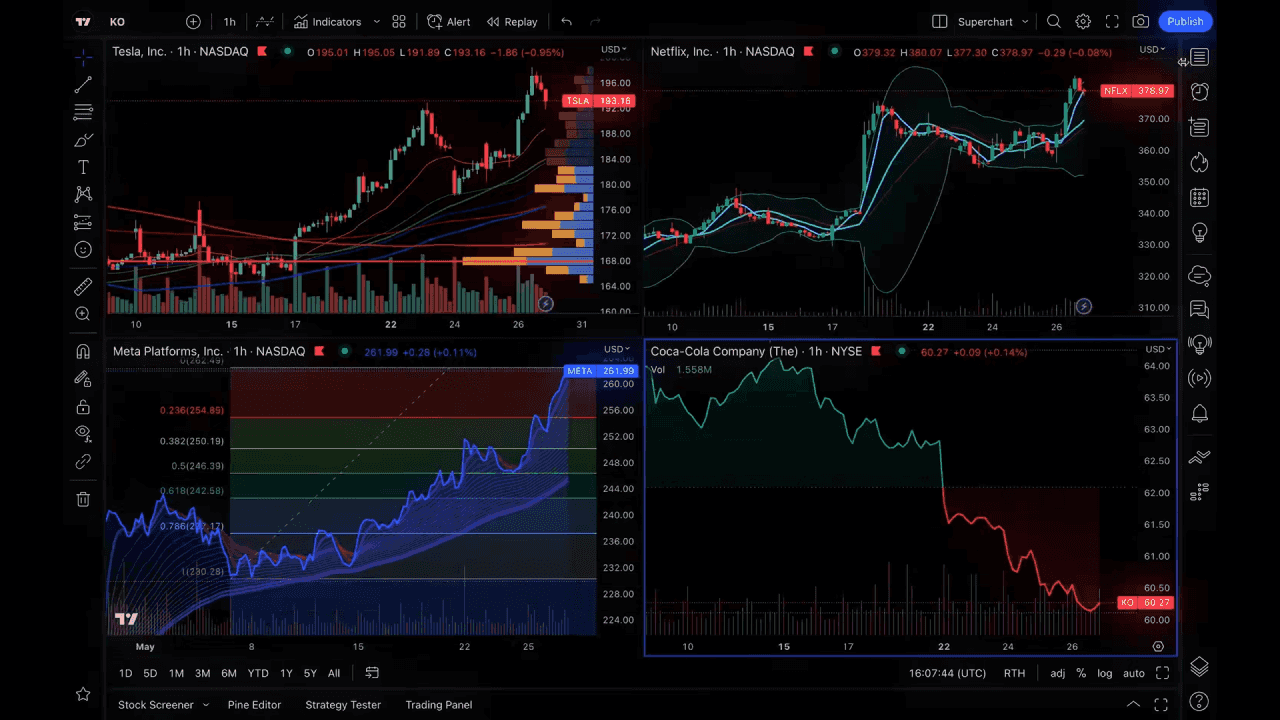

TradingView is a financial data analytics and social media platform for traders and investors, available as both a desktop and mobile app. Users can access an extensive set of functions provided by the platform or developed by its community to predict market trends based on metrics like opening and closing prices or trading volumes.

Pricing

- Free basic plan

- Four paid plans starting at $12.95/month

- 30-day free trial for certain plans

Image title: TradingView’s market data dashboard

Image source: tradingview.com — Features

Top 5 types of models used in finance

Financial institutions rely on different types of ML and statistical models to make predictions. These can be classified based on the task they perform and how they produce a certain output.

Classification models

Classification models divide data points into two or multiple categories (binary and multiclass classification, respectively) based on their features and can be used to forecast future outcomes. In finance, for example, they can help predict whether a certain company's stock will go up or down.

Time series models

Time series models track a certain variable throughout a specific time period to predict how that variable will be affected in another interval of time. For instance, financial institutions can use time series models to predict how a given metric, such as securities prices or inflation rate, will change over time.

Anomaly detection models

These models identify significant outliers in a data set to predict unexpected events, which makes them popular for fraud detection. For example, if a credit card user purchases a luxury watch in a country where they don’t live, an anomaly detection model will flag the transaction as potentially fraudulent since this behavior deviates from the holder's typical buying patterns.

Clustering models

Clustering models group data points according to their shared features and differences. For instance, they can be a powerful tool for clustering similar customers into segments based on their purchasing or investment patterns and predicting which financial products and services would meet their preferences.

Regression models

These models identify correlations between dependent and independent variables to make predictions based on historical data. For instance, regression analysis can help estimate the returns for stocks based on the market risk premium or the revenues of a business according to the number of salespeople employed.

Benefits of predictive analytics adoption in finance

Increased revenues

Predictive models help financial firms make data-driven decisions about trading and investment to maximize profits.

Easier financial planning

Predictive analytics helps companies forecast cash flows and costs for more accurate budgeting.

Risk mitigation

Predictive analytics-powered capabilities like credit scoring and fraud detection ensure more effective risk management.

Superior customer experience

Organizations can analyze clients’ data to deliver personalized financial services and thus improve customer satisfaction and retention and minimize churn.

Predictive analytics challenges & guidelines

Concerns

Recommendations

Data quality & availability

Like any other data-driven technology, predictive analytics solutions deliver accurate insights and forecasts only when fueled with large high-quality data sets. These may encompass different types of data from multiple systems and external sources.

Like any other data-driven technology, predictive analytics solutions deliver accurate insights and forecasts only when fueled with large high-quality data sets. These may encompass different types of data from multiple systems and external sources.

Integrate heterogeneous data from selected sources (market data providers, credit rating agencies, etc.) via ETL/ELT pipelines and consolidate them into suitable repositories, such as data lakes for cost-effective storage of structured and unstructured data or data warehouses for quick access to cleansed data for analysis. At the same time, connect your predictive analytics solution to other systems and external services directly via APIs to enable seamless data exchange or via middleware architectures like ESB if they use different communication protocols that must be converted.

Model training & performance

Consider using cloud-based ML services like Amazon SageMaker or Azure Machine Learning to get access to scalable computing resources, as well as out-of-the-box algorithms and pre-trained AI models. As for model performance issues, you can mitigate overfitting by splitting model training data into training, validation, and test sets and cross-validate the outputs. At the same time, a common practice to address model drift involves performing multiple post-deployment retraining iterations to fine-tune its output.

Security & compliance

Financial companies operate in a highly regulated market with strict data protection standards and legislation. Furthermore, financial data is sensitive information that can easily become a target for fraudsters and cybercriminals, resulting in breaches and leaks.

Financial companies operate in a highly regulated market with strict data protection standards and legislation. Furthermore, financial data is sensitive information that can easily become a target for fraudsters and cybercriminals, resulting in breaches and leaks.

Use obfuscated data, namely data sets anonymized via data masking techniques, to train your model. Additionally, make sure to design and utilize your predictive analytics solution in full compliance with applicable data management and security regulations, such as GDPR and PCI-DSS. This includes protecting the solution with security measures like data exchange encryption, identity and access management, and multi-factor authentication.

Our predictive analytics services

.jpg)

Our consultants can guide your organization throughout the predictive analytics software implementation process, assisting with business analysis, data audit, solution conceptualization, project planning and supervision, and user adoption.

Implementation

We help you implement predictive analytics solutions tailored to your business needs, taking care of architecture design, custom solution development or platform customization, integration, testing, and deployment to the target environment.

Support & modernization

Our specialists provide user training to facilitate predictive analytics solution adoption, perform ongoing maintenance to ensure your solution operates seamlessly, and enhance it via functional improvements or other upgrades to align it with emerging business needs and tech trends.

Leverage predictive analytics with Itransition’s guidance

Navigating volatile markets with predictive analytics

While predictive analytics systems can't see the future, they often highlight the correlations between certain variables or trends. This allows financial institutions and other organizations to better understand how past or current conditions may lead to future events and use these insights to address market uncertainty and refine their financial decisions.

Consider teaming up with an experienced IT partner like Itransition to take full advantage of predictive analytics and other advanced technologies and achieve better business outcomes.

FAQs

Who can benefit from using predictive analytics tools in finance?

A wide range of finance professionals can rely on predictive analytics software to support their decision-making, improve risk management, and forecast future trends in cash flows, customer behavior, and market dynamics. For example, Chief Finance Officers (CFOs), financial analysts, and treasury managers can use predictive insights to optimize corporate finance strategies, forecast liquidity needs, and refine capital allocation. Similarly, investment managers apply predictive models to forecast market trends, assess investment opportunities, and optimize portfolios. In addition, financial controllers, risk managers, and compliance managers can use predictive analytics software to detect anomalies and forecast operational and regulatory risks.

What skills do you need to use predictive analytics tools?

Professionals who use predictive analytics tools require deep financial domain knowledge combined with analytical and technical skills to be able to prepare datasets for analysis, apply ML and statistical algorithms, correctly interpret the insights generated, and formulate actionable strategies based on them.

How accurate are AI-powered predictive analytics forecasts?

While AI-powered predictive models can significantly improve forecasting accuracy compared to traditional methods, they inherently involve some level of uncertainty. The accuracy of generated insights depends on the quality and completeness of the data used, the choice of algorithms, and the constantly changing market conditions that can lead to model drift. Thus, finance professionals working with predictive analytics need to be highly skilled to correctly interpret model outcomes and make decisions based on the insights provided.

How can financial institutions prepare for the adoption of predictive analytics software?

To prepare for predictive analytics adoption, start by assessing your institution’s data readiness, identifying key business objectives, and ensuring access to high-quality datasets. Then, define the predictive analytics solution’s use cases and select the most suitable tools or platforms to address them. Finally, establish governance, compliance, and security measures upfront to ensure a smooth implementation and secure operation of the solution.

Insights

AI in fintech: use cases, solutions, trends & implementation challenges

Explore key areas of application, real-life examples, trends, and benefits of AI in fintech, along with adoption challenges and strategies to address them.

Case study

BI consulting and engineering for a commercial bank

Find out about Itransition's high-profile BI consulting for a Canadian bank, including data architecture analysis and a BI strategy.

Insights

Business intelligence for finance: capabilities, tools & integrations

Explore how business intelligence and data analytics benefit the financial services sector and learn what capabilities, integrations, and tools make up a successful BI strategy.

Case study

Dedicated team for investment portfolio management ecosystem

Learn how we developed a suite of investment portfolio management tools and custom algorithms now used by thousands of investors.

Insights

Wealth management software

Discover how wealth management software facilitates the provision of financial advice, improves asset management, and creates best-in-class investor experiences.